All the Information You Need to Claim a Mileage Tax Deduction

There are many things to consider before claiming your mileage tax deduction. These include limits, documentation, apps, and standard method. If you have a business vehicle and are using it for personal use, it’s essential to use the standard mileage deduction. However, if you use a vehicle for business, you can use a standard mileage deduction in the first year.

Documentation

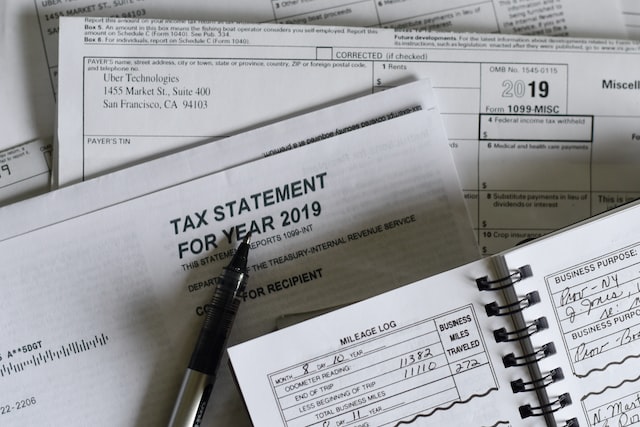

To claim a mileage tax deduction, you must keep a comprehensive log of your business miles. This log should be kept for at least three years. It must contain information about the date, destination, and purpose of business trips. You should also note your total mileage for the year.

Whether you use a car, truck, or motorcycle for business, you must document mileage. You must keep detailed records for every trip, and it is essential to provide your employer with all pertinent information. If you are reimbursed for expenses without documentation, you must pay taxes on the value of your reimbursement. The IRS considers the unaccounted usage of company vehicles as personal use, so it is best to include the value in your income.

The mileage log should be updated regularly and accurately. This helps the IRS to distinguish business trips from personal trips. Moreover, updating your records will be helpful if the IRS audits you. Also, it would help if you used a standard mileage rate when you log mileage. You should also keep all receipts and documents related to vehicle expenses.

Limitations

There are several limitations to claiming a mileage tax deduction, which can limit how much you can claim. The standard mileage deduction does not account for depreciation, calculated into every business mile. You can also use the actual expense method, resulting in a larger deduction. However, it is essential to note that you must use the same method in future years to claim the deduction.

If you want to claim a mileage tax deduction, ensure you have the proper documentation. You should keep a log of your mileage for at least three years. Additionally, you should make a copy of the log for yourself. You can claim up to 58.5 cents for each mile you drive for business purposes as long as the trip is related to your business.

Apps

There are many ways to track business mileage, but one of the best ways is to use an app that tracks mileage. These apps can help you track your business expenses and claim the deduction on your taxes. The apps use GPS to track mileage and save it in categories. You can also upload paper receipts to the app. Some even have credit card integration so that you can keep track of your transactions.

A great mileage-tracking app can save you a lot of time. It helps you record accurate logs and keep track of toll and fuel expenses. It can also help you prepare for your tax filings, saving you up to 20 hours per year.

Standard method

When calculating your mileage tax deduction, the standard method requires you to log the total number of miles driven. This method requires meticulous record-keeping but can result in a larger deduction than the standard mileage rate. However, it requires you to maintain a log for every year you use your vehicle for business purposes. In addition, you must take a picture of your odometer at the start of the year.

If you use a leased car, the standard mileage rate must be used for the first year. This method is required for the duration of the lease, even if you use a different vehicle each year. You can switch to the actual expense method in the years that follow.

Actual Expense Method

You can claim your mileage tax deduction in the standard mileage rate or the actual expense method. To utilize the standard mileage rate, you must record all your automobile has traveled and divide the sum by the miles it has traveled. However, the actual expense technique can be used to keep a mileage diary. You must have copies of all pertinent receipts, including those that show the date, total cost, and details of the goods or services you paid for. The cost must also have been incurred during the tax year.

Using the actual expense, you can write off costs for your autos, like maintenance, repairs, or gas. This method allows you to deduct the costs of using your car for business purposes. The standard mileage rate is based on a standard mileage rate set by the IRS. To claim this rate, you must own or lease your car and not be part of a fleet. However, it would help if you remembered that the standard mileage rate is only valid in the first year of operation and is optional for subsequent years.